Get a FREE Car with DeFi Liquidity Pools

NOTE: Nothing in this article is financial advice and is for educational/entertainment purposes only. Investing in Liquidity Pools is extremely risky.

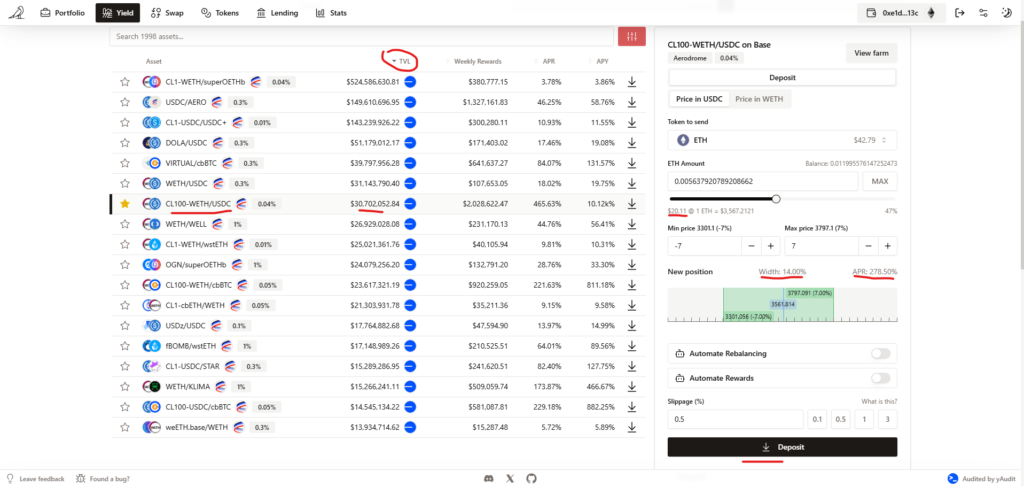

According to Google the average car payment in the United States is $734 which is crazy! This is how to cover a car payment of up to $750 with the power of DeFi Liquidity Pools. For this example, we will be using vfat.io on Base Network to find our liquidity pool.

Here is the Criteria:

- Find a good liquidity pool that consistently pays 120% APR or more

- $15,000 – $20,000 for a deposit

- Position Management

- Goals and tracking progress

- Assumptions: You understand how to harvest and compound fees on vFAT

Using Vfat to Source Liquidity Pools and Depositing

In my opinion vfat makes finding and managing liquidity pools super easy but unfortunately, vfat is only available on ETH and BNB chains for now.

For this example, I will be choosing a high cap ETH(WETH) and a stablecoin USDC pair. The high TVL will help protect against slippage especially if I plan to deposit an amount like $20K. Also, the $20K will not have an impact on the APR because the TVL is large ($30 Million) compared to the deposit amount. As a rule of thumb, I only consider depositing in TVLs over $1 million.

I will be depositing only $20 for reference but just imagine its 1000x!

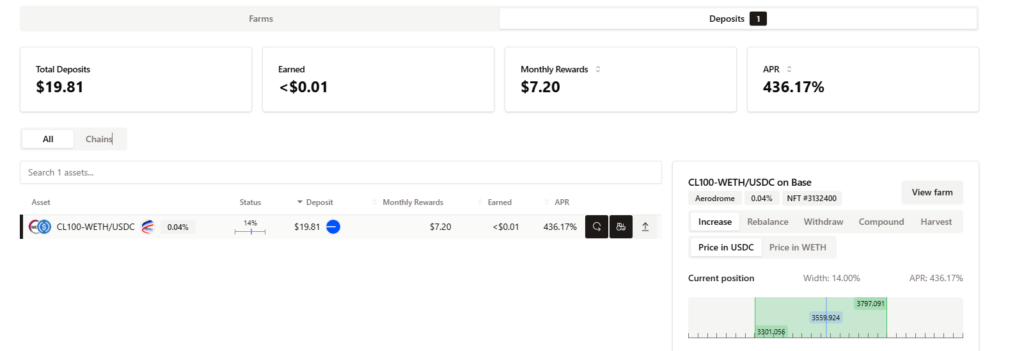

vFat will do it’s best to get the position up to the desired deposit amount but it seldom ever does. No need to panic about this as the unused deposit amount will be redeposited back into my wallet. In this case vFat created a position with $19.81 of the $20.00 I attempted to deposit. I can also expect this to happen for rebalancing which is another reason to choose pools with a high TVL.

In the above image my APR is 436% and my Monthly Rewards are $7.20. Before you get too excited these numbers are highly dependent on current volume and TVL. The higher the volume of trades in the pool (For this pool its WETH/USDC) relative to the TVL the higher the APR will be.

I also chose a position width of 14% in the middle which means the price of ETH can move up or down by 7% relative to the price of USDC to stay in range and continue earning rewards. A 14% range is wide range but when volume inevitably dies down the APR will tank and I may choose to rebalance to a narrower range to capture more rewards.

Conversely if I’m in a narrow range in my LP and the volume spikes I may decide to rebalance to a larger range to avoid the price moving out of my range. However, be careful with rebalancing too often especially if price has moved significantly out or range. My rule of thumb is to keep my LPs in a wide-ish range and accept that volume is dynamic, so I’ll have periods of high volume/high rewards and low volume/low rewards. As long as I’m earning my goal amount of 10% per month in rewards.

Goals and Tracking

Call me old school but I enjoy tracking on good ol faithful excel. There are some portfolio trackers out there, but they only give you a snapshot of your current portfolio. I like to see how my portfolio is tracking over time.

I’m no excel expert, so I like to keep it simple. An excel file with daily tab and monthly tab just to make sure I’m on track with the following

Daily Tab Columns

- Date

- Spot Total (Amount in wallet) +

- LP Value +

- Fees not claimed +

- Lending +

- Borrowed –

- Total =

Monthly Tab Columns

- Month/Year

- Present Value(1st of month amount before removing Payment)

- Payments ($750 Withdrawal)

- Profit or Loss (Present Value – Ending balance for the month)

Closing Thoughts

If done correctly and under the correct conditions. you should be able to draw down the account by $750 each month and reinvest the difference if any to minimize down months. You might end up with a small loss or even a big profit in a bull market. But the goal is at the end of 3-5 years you end up with $20,000 or more and a paid off car.

Even if by the end of 5 years you have less than $10,000 in the account but paid off a $50,000 car, I’ll take that any day! Don’t forget about taxes! Make sure to consult with your tax professional on your tax calculation!